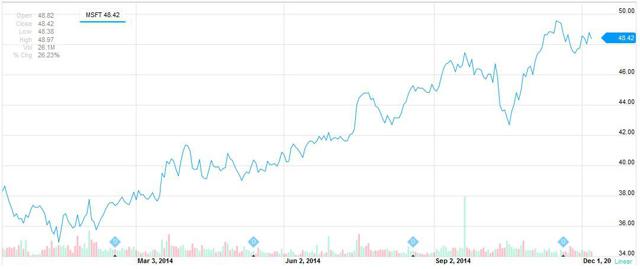

Since the start of the year, Microsoft (MSFT) has added almost $90 billion in market capitalization, as its shares have appreciated by about 33% from $36.41 on December 31, 2013 (on a split and dividend adjusted basis) to $48.42 on December 5, 2014. Microsoft market capitalization today stands at $399 billion, higher than the annual GDP of oil rich United Arab Emirates and Thailand (according to the World Bank). It ranks as the second largest U.S. company after Apple (AAPL) ($674 billion) and ahead of Exxon (XOM) ($397 billion). This year alone, the $90 billion increase in Microsoft's market capitalization is larger than oil rich Oman's 2013 GDP of about $80 billion. Can Microsoft shares maintain such gains and appreciate much further, or is it time to sell?

(click to enlarge)

Microsoft 1-Year Stock Price Chart - Source: Yahoo Finance

Valuation

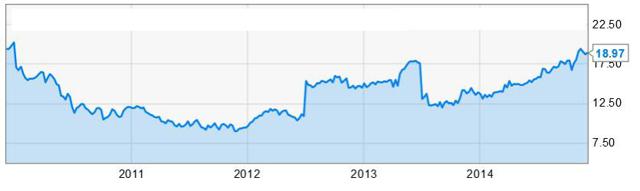

Microsoft currently has a Price/Earnings ratio of 19 on a twelve months trailing basis. Such level is currently close to its highest levels during the past five years, as per below chart.

(click to enlarge)

Microsoft 5-year P/E ratio (TTM) - Source: Y-Charts

With average analysts' earnings estimates of $2.67 per share for the year ending June 2015 and $3.14 per share for the year ending June 2016, Microsoft's forward P/E ratios are 18.1 and 15.4 respectively. Such ratios are relatively expensive, driven primarily by the expected release of Windows 10 in 2015. In anticipation of such release, Microsoft shares are approaching their historical stock price peak levels seen in 1999/2000 prior to the bursting of the internet bubble.

(click to enlarge)

Microsoft stock price from 1985 to 2014 - Source: Yahoo Finance

Windows 10

Could the expected release of Windows 10 provide further fuel to Microsoft's stock price? Windows is currently used by about 1.5 billion people globally, while Windows 10 is being promoted by Microsoft as a game changer, primarily for having the capability to run a broad set of devices, with one platform application for developers. As Terry Myerson wrote:

Windows 10 represents the first step of a whole new generation of Windows. Windows 10 unlocks new experiences for customers to work, play and connect. Windows 10 embodies what our customers (both consumers and enterprises) demand and what we will deliver.

Windows 10 will run across an incredibly broad set of devices - from the Internet of Things, to servers in enterprise data centers worldwide. Some of these devices have 4 inch screens - some have 80 inch screens - and some don't have screens at all. Some of these devices you hold in your hand, others are ten feet away. Some of these devices you primarily use touch/pen, others mouse/keyboard, others controller/gesture - and some devices can switch between input types.

Since 1985, Microsoft has released a new major version of its Windows operating system about once in every 3 years:

| 20-Nov-85 |

Windows 1.0 |

| 9-Dec-87 |

Windows 2.0 |

| 22-May-90 |

Windows 3.0 |

| 27-Jul-93 |

Windows NT 3.1 |

| 24-Aug-95 |

Windows 95 |

| 25-Jun-98 |

Windows 98 |

| 17-Feb-00 |

Windows 2000 |

| 25-Oct-01 |

Windows XP |

| 11/8/2006 - 1/30/2007 |

Windows Vista for Business use - Windows Vista for Home use |

| 22 July 2009 |

Windows 7 |

| 26-Oct-12 |

Windows 8 |

Windows release dates - Source: Wikipedia

It is interesting to note that in general, Microsoft stock price performs better leading to the Windows release, as opposed to following the release. Below is a table whereby for every Windows version, we calculated the change in Microsoft stock price in the 12,9,6 and 3 months leading to the Windows release, as well as following the release. On average, Microsoft stock price appreciated by an average of about 42%, 31%, 23% and 11% in the 12,9,6 and 3 months leading to the release. For the period following the release, it only showed an average appreciation of about 3.4% in the 3 months following the release, while it depreciated by an average of -4%, -9% and -7% in the 6,9, and 12 months following the release.

| Vers. |

-12 months |

-9 months |

-6 months |

-3 months |

On Release |

+3 months |

+6 months |

+9 months |

+12 months |

| 2 |

91.7% |

15.0% |

-14.8% |

-17.9% |

0.23 |

-28.1% |

-25.8% |

-14.8% |

-4.2% |

| 3 |

144.8% |

144.8% |

61.4% |

47.9% |

0.71 |

34.0% |

4.4% |

-30.4% |

-33.0% |

| NT |

3.7% |

-14.2% |

-12.4% |

-8.6% |

1.69 |

-5.6% |

-10.6% |

-20.7% |

-23.9% |

| 95 |

72.4% |

56.7% |

57.3% |

9.9% |

4.31 |

9.4% |

-7.1% |

-18.8% |

-21.9% |

| 98 |

56.9% |

53.1% |

70.9% |

19.6% |

18.2 |

-10.2% |

-28.3% |

-43.5% |

-40.2% |

| 2000 |

32.9% |

25.9% |

17.8% |

17.2% |

35.7 |

47.2% |

39.2% |

44.2% |

73.8% |

| XP |

2.1% |

1.2% |

-10.2% |

-7.3% |

22.42 |

-1.9% |

16.5% |

46.1% |

18.8% |

| Vista |

8.7% |

8.9% |

23.0% |

19.5% |

23.97 |

-3.9% |

-2.4% |

-19.6% |

-11.5% |

| 7 |

-1.6% |

17.5% |

46.9% |

32.9% |

21.53 |

-7.2% |

-15.2% |

-22.1% |

-5.8% |

| 8 |

9.0% |

-2.5% |

-11.0% |

-2.6% |

26.43 |

0.3% |

-12.7% |

-12.9% |

-23.4% |

| |

|

|

|

|

|

|

|

|

|

| Average |

42.1% |

30.7% |

22.9% |

11.1% |

|

3.4% |

-4.2% |

-9.3% |

-7.1% |

Microsoft stock price performance from Windows release date - compiled from raw data provided by Yahoo Finance

| Vers. |

-12 months |

-9 months |

-6 months |

-3 months |

On Release |

+3 months |

+6 months |

+9 months |

+12 months |

| 2 |

0.12 |

0.2 |

0.27 |

0.28 |

0.23 |

0.32 |

0.31 |

0.27 |

0.24 |

| 3 |

0.29 |

0.29 |

0.44 |

0.48 |

0.71 |

0.53 |

0.68 |

1.02 |

1.06 |

| NT |

1.63 |

1.97 |

1.93 |

1.85 |

1.69 |

1.79 |

1.89 |

2.13 |

2.22 |

| 95 |

2.5 |

2.75 |

2.74 |

3.92 |

4.31 |

3.94 |

4.64 |

5.31 |

5.52 |

| 98 |

11.6 |

11.9 |

10.65 |

15.22 |

18.2 |

20.26 |

25.4 |

32.2 |

30.43 |

| 2000 |

26.87 |

28.4 |

30.3 |

30.46 |

35.7 |

24.25 |

25.64 |

24.8 |

20.54 |

| XP |

21.95 |

22.2 |

24.97 |

24.18 |

22.42 |

22.86 |

19.25 |

15.4 |

18.88 |

| Vista |

22.06 |

22 |

19.48 |

20.06 |

23.97 |

24.93 |

24.56 |

29.8 |

27.08 |

| 7 |

21.87 |

18.3 |

14.66 |

16.2 |

21.53 |

23.21 |

25.39 |

27.7 |

22.86 |

| 8 |

24.25 |

27.1 |

29.7 |

27.14 |

26.43 |

26.34 |

30.28 |

30.3 |

34.52 |

Microsoft stock price (split & dividend adjusted) - Source: Yahoo Finance

Naturally, there are several factors other than Windows that affect Microsoft. Nevertheless, we have concentrated on Windows as we believe it remains the key driver for the company. Despite Microsoft's stellar performance year-to-date, and although past performance is not necessarily indicative of future performance, we believe that the upcoming release of Windows 10 will provide further support to the shares. If Microsoft's implied claim that Windows 10 is a game changer is true, then the current gains in its share price may experience further substantial gains during the next several months. However due to Microsoft's current rich valuation, we would not maintain such long position for too long, aiming to exit prior to the release of Windows 10, while possibly considering purchasing puts to hedge such position.